Fewer people are writing checks, thanks to advances in direct deposit, online autopay for bills and payment apps, however, that doesn’t mean paper checks are going away (not yet, at least). To set up automatic payments from your bank account for bills, set up direct deposits to your bank account from your employer and complete ACH transfers, you’ll need to know how to void a check.

What Is a Voided Check?

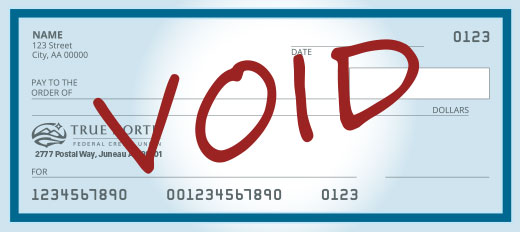

Voided checks are real checks that can no longer be used as legal tender. The moment you void a check, you’ve rendered that check useless for actual payment purposes.

How to Void a Check

- Use a blue or black ink pen.

- Write the word “VOID” in large letters across the front of the check, or you can write “VOID” in capital letters on the date line, payee line, payment amount box, amount line and signature line.

- Avoid writing “VOID” over the routing number and bank account number at the bottom, as these are what will be used to set up your bank account for direct deposit or withdrawals.

What to Do If You Don’t Have Checks

People depend on a mixture of mobile wallets, payment apps, debit cards, direct deposit and electronic bill payments to handle their finances, rendering checks useless for many. As such, there are people out there with bank accounts who simply do not have a checkbook.

So what happens if you don’t have a checkbook but need a voided check? You have a few options:

- You can order checks. You can order checks from companies outside your financial institution or reach out to your financial instution directly to order checks.

- You can request a starter check. You can request your local branch can print you a starter check to void. They should be able to print this in-house for a much faster turnaround.

- You can get a deposit slip. The point of voiding a check for direct deposits or autopay is to give an institution a verifiable copy of your routing and account numbers. A deposit slip contains the same information as a voided check, and most banks offer these to members.

- You can request other documentation. If all else fails and you’re in a hurry to provide someone with your account number and routing number on something official from your bank or credit union, request other documentation, like a note on your bank’s letterhead. This may suffice when setting up direct deposit or ACH information.

- You can set up details online. Many utility companies and other recipients of your monthly payments don’t request voided checks when you sign up online. Some will make inconsequential withdrawals (and almost immediately return the funds) just to verify that you’ve set up the account correctly to pay bills online, so make sure your checking account is adequately funded before trying this out to avoid overdraft fees.

Why You Might Be Asked to Void a Check

- Direct deposit: Often, employers will request a voided check to set up direct deposit for your paycheck, meaning the money will go straight into your bank account. The voided check allows your employer to see your account information, including your bank account number and routing number, and ensure they’ve been accurately entered into your employer’s payroll system.

- Automatic electronic payments or general money withdrawals: Companies that automatically withdraw money from your checking account, like your mortgage company, will want to ensure they have your correct bank account information. They’ll use an actual, legal check to set up bill payments from your account. You may also need to provide a voided check for other bill pay scenarios, though this is not as common. You should use a blank check for this purpose as well.

- Mistakes: You can also cancel a check if you make a mistake while writing it. For example, if you are writing a $100 check but accidentally tack on an extra zero (making it $1,000), it’s safer to cancel the entire check so that no one accidentally withdraws $1,000 from your account before you can stop them. See below on how to cancel a check.

How to Cancel a Check

So what do you do if you need to cancel a check payment when you’ve already handed the check over to someone else? Are you out of luck? Not entirely.

Canceling a check is different from voiding a check and is typically accompanied by some urgency.

Let’s say you have sent a check and realized afterward that you have made an error, such as overpayment. You must contact your bank quickly to cancel it. You will need the following information:

- The check number

- The amount the check was made for

- The date of the check

- The check recipient’s name or business name

- The reason for the stop payment

Guide to Every Part of a Check

If the check has already cashed or deposited, do not try the stop payment online. Visit your financial institution in person or give them a call.