Manage Your Credit With Confidence

Americans are in the dark

It’s difficult to make financial decisions when you don’t have all the information. According to recent surveys, Americans are “in the dark” when it comes to their credit score and interest rates on credit cards.

31% don’t know their credit score

47% don’t know their credit card interest rate

SavvyMoney Score Simulator

The Score Simulator, available within Credit Score in True North’s eBanking platforms, is an educational tool designed to help you understand how your credit score is impacted by different credit decisions. The simulations are hypothetical and will have no impact on your actual credit score.

See How It Works

Personalized Visualizations

The Score Simulator leverages your unique credit data and credit score to simulate how different financial decisions could impact your credit score.

Real-Time Insights

In real-time, you can see how your credit score could change by making different decisions and how a combination of decisions could affect your score.

Score Simulator Helps Assess Financial Decisions

![]()

Apply for New Credit

- Get a new credit card with a credit limit of __?__

- Transfer credit card balances to a new card

- Inquiry on file from a credit card application

![]()

Apply for New Loan

![]()

Manage Your Balances

- Increase balance on credit cards

- Raise your credit limit on credit cards

- Pay down balances on credit cards

- Pay off all credit card balances

- Close the oldest credit card

![]()

Manage Payment Activity

- Miss a monthly payment

- Make on-time payments for “X” number of months

.

Score Simulator Is A Game Changer

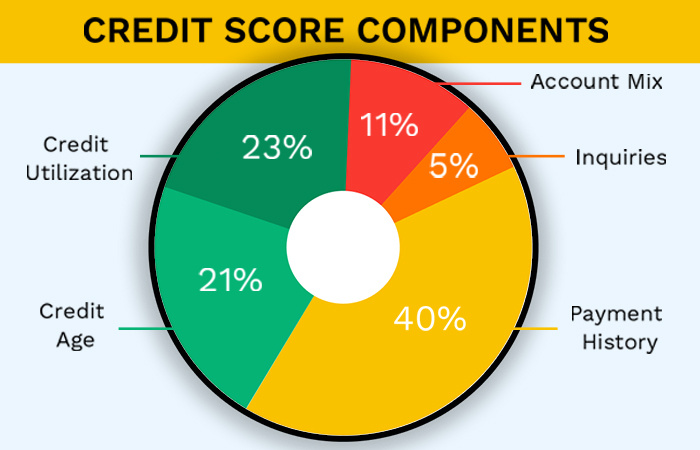

Improve Your Financial Literacy: Gain a deeper understanding of credit by simulating how your credit score is impacted by different scenarios.

Promote Your Credit Health: Develop positive credit behaviors by understanding which financial decisions have the greatest impact on your credit score.

Lowers Credit Anxiety: Visualization of hypothetical scenarios removes the uncertainty of future credit decisions.

Saves You Money: By understanding which moves are the most beneficial to improving your credit score, you can increase your chances of lower interest rates, helping you save more money.

Empower Yourself with Score Simulator

The Score Simulator is easy to use, personalized to your unique credit profile, and can be easily accessed through Credit Score in True North’s eBanking platforms.